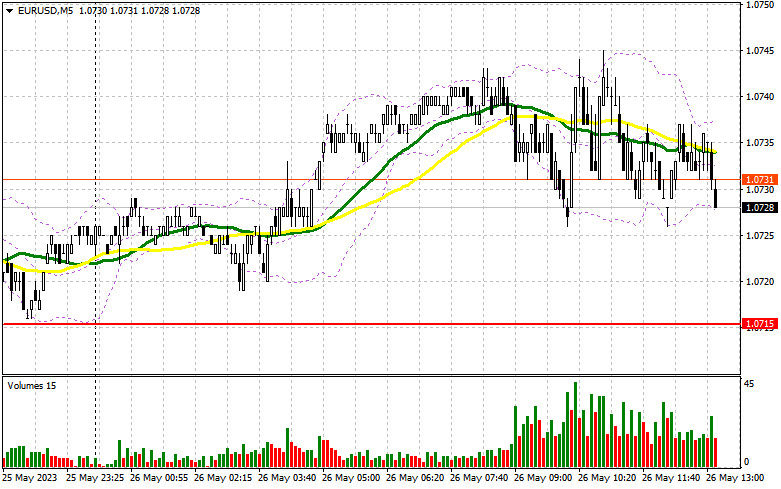

In my morning forecast, I drew attention to the level of 1.0715 and recommended making entry decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The price didn't reach this range, and due to low market volatility, no signals were formed. The technical picture remains unchanged for the second half of the day.

For opening long positions on EUR/USD, the following is required:

There were no news releases from the Eurozone in the first half of the day, so the focus now shifts to US data. The figures for changes in US personal income and spending are expected. Still, the Personal Consumption Expenditures Price Index, a preferred inflation indicator by the Fed, will be of more interest. An increase in the index may lead to a decline in the EUR/USD pair, while a decrease can help the euro recover from its lows and form an upward correction at the end of the week. The change in Core Durable Goods Orders will also be an interesting point to watch.

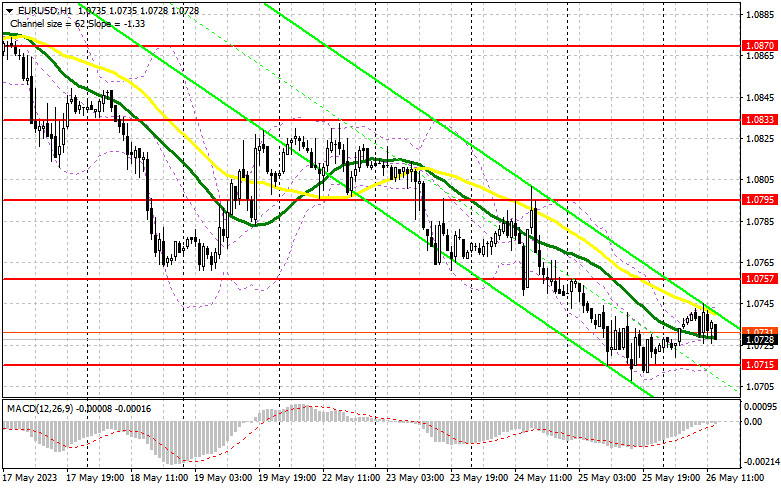

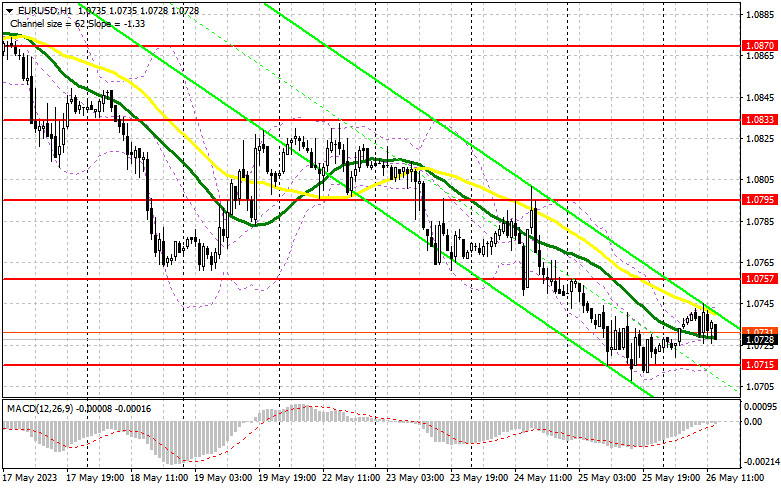

Due to this, I will act based on the morning scenario. As long as trading remains above 1.0715, buying predominates in the market, and we can expect an upward correction in the pair. A decline and a false breakout at this level, similar to yesterday, would indicate the presence of market participants pushing the euro up against the bearish trend, providing an opportunity to enter long positions with a target of growth towards the nearest resistance at 1.0757, just below which the moving averages, playing on the bearish side, are located. A breakout and a top-down test of this range after weak US reports and breakthroughs in US debt limit negotiations will strengthen demand for the euro, forming an additional entry point for increasing long positions with a new high around 1.0795. The ultimate target remains around 1.0833, where I will take profits.

In the scenario of further decline in EUR/USD and the absence of buyers at 1.0715 in the second half of the day, which is less likely, we can expect further development of the bearish trend. Therefore, only a false breakout around the next support level at 1.0674 would signal a buying opportunity for the euro. I will open long positions from the minimum of 1.0634, targeting an upward correction of 30-35 pips within the day.

For opening short positions on EUR/USD, the following is required:

Sellers are not rushing to re-enter the market, especially ahead of the interesting US statistics. Protecting the immediate resistance at 1.0757 remains a priority task and a suitable scenario for increasing short positions in the second half of the day, in line with the trend. A false breakout at this level will provide a sell signal capable of pushing the pair toward the minimum at 1.0715. Consolidation below this range and a reverse test from below to above will pave the way to 1.0674. The ultimate target will be the minimum at 1.0634, where I will take profits. In case of upward movement of EUR/USD during the American session and the absence of bears at 1.0757, we can count on a correction in the pair. In that case, I will postpone short positions until the level of 1.0795. Selling can also be considered there, but only after an unsuccessful consolidation. I will open short positions from the maximum of 1.0833, targeting a downward correction of 30-35 points.

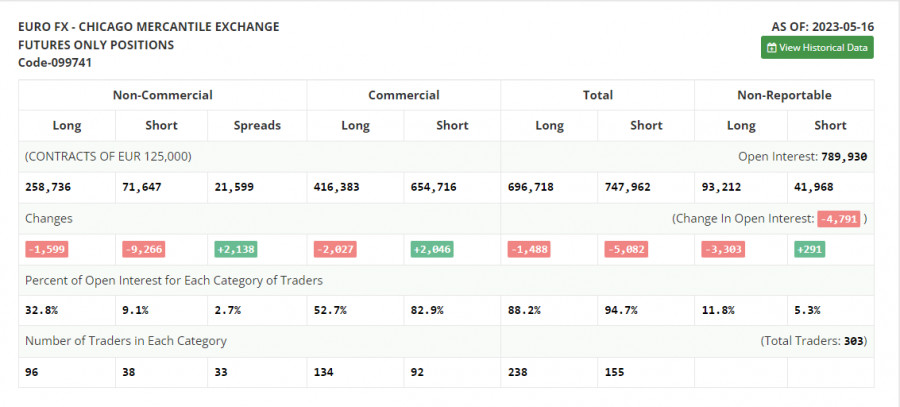

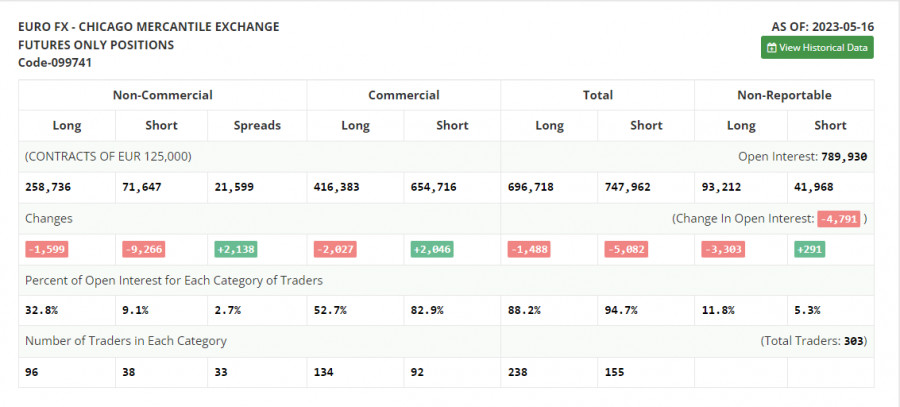

In the COT report (Commitment of Traders) for May 16, there was a decrease in both long and short positions, but the latter decreased significantly. The corrective downward movement of the euro we observed last week remains a good reason to increase long positions. Until the issue of the US debt limit is resolved, it is unlikely that we will see a significant demand for risky assets. Traders even ignore statements from Federal Reserve representatives who unanimously state that the committee will pause the rate hike cycle at the next meeting, which is a fairly bullish signal for the euro. So, as soon as the debt limit issue is resolved, buyers will return to the market, but we need to wait a little longer for the bearish scenario. The COT report indicates that non-commercial long positions decreased by only 1,599 to 258,736, while non-commercial short positions decreased by 9,266 to 71,647. At the end of the week, the overall non-commercial net position increased to 187,089 from 179,422. The weekly closing price decreased to 1.0889 from 1.0992.

Indicator signals:

Moving averages

Trading occurs around the 30-day and 50-day moving averages, indicating market uncertainty.

Note: The author considers the period and prices of the moving averages on the H1 hourly chart, which differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands

In case of an upward movement, the upper boundary of the indicator around 1.0750 will act as resistance.

Description of indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting specific requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open positions of non-commercial traders.

• The net non-commercial position is the difference between non-commercial traders' short and long positions.