While ether is moving toward $1,700 and bitcoin is clinging to the $23,000 mark, Japan is urging global regulators to approach cryptocurrencies with the same rigor as banks. This appeal comes in the wake of the collapse of the Sam Bankman-Fried FTX digital asset exchange. According to Mamoru Yanase, deputy director general of the Financial Services Agency's Strategy and Management Bureau, "Cryptocurrency has become so enormous." "You must use the same procedures as you do for the market of traditional financial instruments if you wish to execute effective regulation in the digital asset market."

However, several experts have consistently stated that the current laws and rules used to regulate financial institutions do not apply to the market for digital currencies, including cryptocurrencies. Consequently, Mamoru Yanase's plan to move the current legislation to a new area, at the very least, won't produce any outcomes; at the most, it will further injure the market and its participants.

Yes, FTX's bankruptcy and the fraud charges brought against its CEO have hurt the crypto industry and exposed inconsistencies in the regulation of digital assets around the world. Investors who will be able to withdraw their money from the local FTX branch next month are better protected thanks to several Japanese regulations, but it is unlikely wise to follow their lead given how the Japanese government generally views the cryptocurrency industry.

The new issue wasn't caused by crypto technology, according to Yanase, who also worked in financial oversight. "Weak internal controls, lax regulation, and a lack of oversight" are the causes of this. It's challenging to argue against this.

Yanase claims that the Japanese regulatory agency has started urging its peers in the US, Europe, and other nations to regulate cryptocurrency exchanges similarly to how banks and brokerage firms are regulated. However, it is important to note that many industrialized nations are already attempting to do this, which merely causes stress on the bitcoin market and forces its participants to find fresh security flaws and ways to avoid regulation.

The German Securities Supervisory Authority has urged for the creation of international regulations and standards to preserve financial stability, while the Securities and Exchange Commission in the US has made it clear that it will step up its investigation of cryptocurrency companies. Retail customers would be shielded from the volatile virtual asset market by the Central Bank of Singapore.

To make sure that cryptocurrency companies are employing offline wallets to properly manage consumer assets, Yanase added that officials should be able to perform on-site inspections of the businesses. He contends that nations must establish an international system for resolving disputes to coordinate responses if significant cryptocurrency businesses fail.

Regarding the technical picture of bitcoin today, the level of $23,180 is already the bull's closest goal. If you fixate on it, you'll create a new bullish trend with the potential to update $23,680. The $24,420 region will be the farthest objective, where significant profit-taking and a rollback of bitcoin may take place. In the case of renewed pressure on the trading instrument, protecting the $22,520 level will be of utmost importance because a breach by sellers would be detrimental to the asset. This will put pressure on bitcoin and create a direct path to $21,840. The first cryptocurrency ever created will "drop" in this region along with $21,320 if this level is broken.

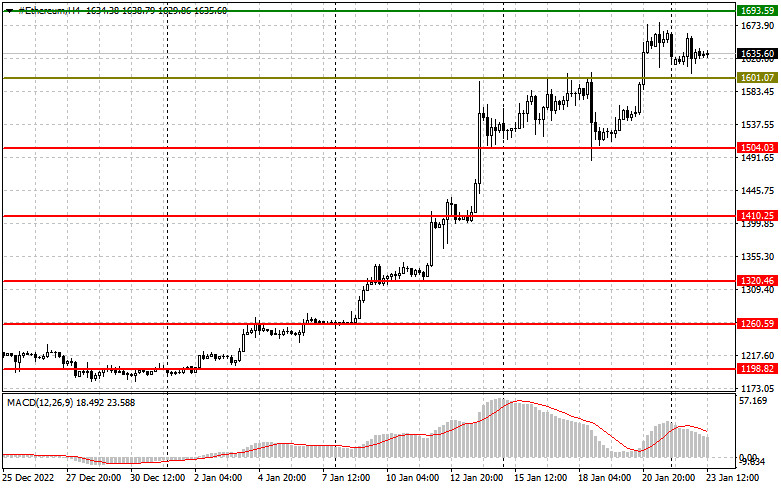

The breakdown of the nearest resistance at $1,693 is what ether buyers are concentrating on. This is going to be sufficient to establish a foothold at the current highs and keep the bullish trend going. The market will undergo considerable adjustments as a result of this. The balance will be returned to the ether upon consolidation above $1,693, with the possibility of an increase up to a maximum of $1,758. A second target will be in the $1,819 range. The $1,504 level, which was just formed, will come into play when the pressure on the trading instrument resumes and the $1,600 support collapses. If it succeeds, the trading instrument will rise to a minimum of $1,410. It will be extremely difficult for bitcoin owners to trade below $1,320.